Student Loan Application Process

The William D. Ford Direct Loan is the federal student loan program utilized by Trocaire students. To apply for a federal student loan, you must first complete and submit a FAFSA. Based on the results of your FAFSA form, The Financial Aid Office will notify you of your eligibility via a Financial Aid Offer Letter, which may include federal student loans. Direct Loans can be either subsidized or unsubsidized. Subsidized loans are based on financial need and no interest is charged as long as you maintain continuous half-time enrollment (six credits). Unsubsidized loans are not need-based, and interest is charged to you from the time the loan is credited to your tuition bill. Repayment of Direct Loans begins six months after you graduate, withdraw from the College, or drop to less than half-time status.

All first-time/new borrowers are required to:

- complete Entrance Counseling, a tool to ensure you understand your obligation to repay the loan; and

- sign a Master Promissory Note, agreeing to the terms of the loan.

Federal Parent PLUS Loans

Federal Parent PLUS loans allow parents with good credit ratings to borrow up to the cost of their child’s education, minus any financial aid the student is receiving. These loans are not need-based, but students who have parents wishing to take a PLUS Loan must file the FAFSA.

To receive a parent PLUS loan, you must

- be the biological or adoptive parent (or in some cases, the stepparent) of a dependent undergraduate student enrolled at least half-time at Trocaire College;

- not have an adverse credit history (unless you meet certain additional requirements); and

- meet the general eligibility requirements for federal student aid.

Note: Grandparents (unless they have legally adopted the dependent student) and legal guardians are not eligible to receive parent PLUS loans, even if they have had primary responsibility for raising the student.

Alternative/Private Loan Information

Important Information Regarding Lenders

Trocaire College’s Financial Aid Office is utilizing ElmSelect, a loan comparison website, to provide our students in making comparisons between available alternative/private loan programs. Students have the right to select the lender of their choice.

How to start your lender search:

- Log on to ElmSelect, enter “Trocaire College” and select your loan type:

- Undergraduate

- Health Professional

- Parent/Sponsor Loans

- Check the terms and fine print carefully.

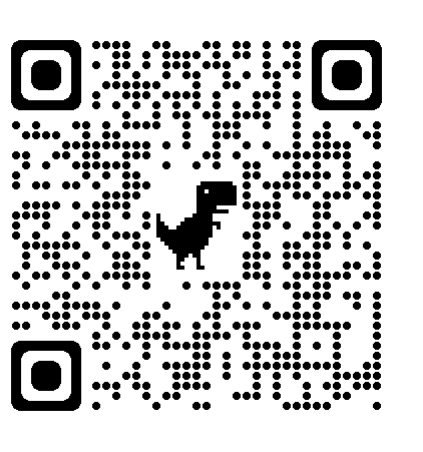

You can use the QR code to go directly to ElmSelect as well.

You can use the QR code to go directly to ElmSelect as well.

NOTE: All alternative loan borrowers must submit a Self-Certification Form to the lender. Most lenders will provide this form to borrowers. If needed, a copy can be obtained at the Financial Aid Office.

Further Questions?

Contact the Financial Aid Office today!